Financial Monitoring of Electricity Companies, Towngas Company, Retail Prices of Auto-fuel and Prices of Domestic Liquefied Petroleum Gas |

|

The Financial Monitoring Division (FMD) deals with the financial aspects relating to the electricity and towngas companies and monitors retail prices of auto-fuel and prices of domestic liquefied petroleum gas.

Monitoring of the Electricity Companies

Monitoring of the Towngas Company

Monitoring of the Retail Prices of Auto-fuel

Monitoring of the Prices of Domestic Liquefied Petroleum Gas

| Monitoring of the Electricity Companies |

The Government has entered into two Scheme of Control Agreement (SCAs), one with The Hongkong Electric Company Limited and HK Electric Investments Limited (referred to collectively as "HEC"); and another with CLP Power Hong Kong Limited and Castle Peak Power Company Limited (CAPCO) (referred to collectively as "CLP").

The SCAs set out the obligations and rights of the power companies, but are not franchises. They do not define a supply area for either company, nor do they exclude newcomers to the market. By signing the SCAs, the power companies undertake to provide sufficient facilities to meet present and future electricity demand of their respective supply areas. At the same time, they are entitled to receive returns at a permitted rate based on their fixed assets. The SCAs also provide the framework for the Government to regulate the power companies and monitor their corporate affairs to protect the interests of consumers. Pursuant to the SCAs, the power companies are required to seek the approval of the Executive Council for certain aspects of their development plans, including projected basic tariff levels, and the agreement of Government to their tariff adjustments. Meanwhile, technical, environmental and financial performances of the power companies are subject to annual auditing review conducted jointly by the Government and the companies.

The existing SCAs are the greenest SCAs ever, focusing on the promotion of energy efficiency and conservation and renewable energy. Under these SCAs, the Government and the power companies have introduced Feed-in Tariff and RE Certificates Schemes, as well as revamped and introduced various energy saving programmes, all of which fully reflect the Government’s commitments to combating climate change.

To get ready for opening up the market, the Government is making all the necessary preparation, so that potential new suppliers can be introduced when the requisite market conditions emerge in the future. The power companies will co-operate with the Government to conduct the interconnection and grid access studies, and publish their segregated cost data in the current regulatory period (i.e. from 2018 to 2033).

The FMD performs the following functions :

- to review the periodic development plans submitted by the power companies;

- to conduct annual auditing review of the companies' performance;

- to examine annual tariff adjustment proposals; and

- to conduct scheduled periodic interim reviews of the terms of SCAs.

| Monitoring of the Towngas Company |

On 3 April 1997, the Government has entered into a three-year Information and Consultation Agreement (ICA) with The Hong Kong and China Gas Company Ltd. The company supplies towngas to most part of the territory. It is not subject to any price or profit regulation by the Government. The agreement is designed to increase the transparency of the company's tariff-setting mechanism and justification for tariff increases. It also stipulates certain procedures for The Hong Kong and China Gas Company Ltd. to consult the Government in the event of tariff adjustments and major system additions and disclose certain corporate information to the public on an annual basis so as to ensure that consumers' interests are protected. The ICA has been extended for three years for the ninth times. The current Agreement is effective as of 3 April 2024 and shall continue in effect until 2 April 2027.

The FMD performs the following functions :

- to ensure that adequate financial, operational, environmental and safety information is made available to the public by the company; and

- to seek clarification and justification from the company for any tariff increases.

| Monitoring of the Retail Prices of Auto-Fuel |

Retail prices of auto-fuel in Hong Kong are determined by oil companies having regard to commercial practices and their operating costs. We appreciated the impact of the auto-fuel prices on the local economy. We have been monitoring whether changes in local retail prices of auto-fuel are in line with the trend movements of international oil price (benchmarked against the Singapore free-on-board (FOB) prices for unleaded petrol and motor vehicle diesel). We have been in close contact with oil companies and urged them to promptly adjust prices in tandem with international oil price movements to lessen the burden on the public.

To assess whether the extent and schedule of adjustments of local auto-fuel retail prices have been reasonable, the following factors should be taken into account -

| (a) | Hong Kong has no oil refinery. All auto-fuels sold locally are imported, and they are refined oil products instead of crude oil. It is not appropriate to simply compare the difference between the international crude oil price and local retail prices; |

| (b) | the comparison between the import prices of auto-fuel (instead of international crude oil price) and local auto-fuel retail prices is an appropriate indicator to accurately assess whether there has been any deviation from the trend movements of international oil price; |

| (c) | apart from the import price and Government duties, the local auto-fuel retail price was also affected by changes in other operating costs such as discounts, land costs, government rent, staff costs, transportation, advertising, maintenance of oil terminal and petrol filling station (PFS), financing, etc. Adjustments in these operating costs may not be in tandem with international oil price movements; and |

| (d) | local oil companies in general replenish their oil stock once to three times a month. They usually maintain an oil stock of around 30 days. According to the analysis on the replenishment frequency data, the actual import price of auto-fuel currently sold reflects the average import prices of the past few weeks. Hence, there is a time lag for the adjustment of international oil price to be filtered through and be reflected in local auto-fuel retail prices. |

Regarding the trend movements of retail prices of auto-fuel, we have compared the changes in local retail prices of auto-fuel and the average monthly import prices since January 2003. In view of the import and stock-piling pattern of oil companies, there is a time lag for the adjustment of the auto-fuel import prices to be reflected in local retail prices. Therefore, the comparison has been made between the average import prices of the previous month and the local retail prices in the current month. Result of the comparison shows that, the trend movements in local retail prices have been generally in line with the average import prices in the previous month.

In a free market economy, the retail prices of auto-fuels are determined by the market. The Government will endeavour to maintain a stable fuel supply, encourage transparency and enhance competition by removing barriers to entry into the fuel market. The Government has taken a series of measures to facilitate the new market entrants including -

| (a) | removing the requirement for bidders of PFS sites to hold import licence and supply contract; |

| (b) | re-tendering all existing PFS sites upon expiry of their leases, instead of renewing the leases to the existing operators; and |

| (c) | depending on the land supply situation, tendering PFS sites in batches consisting of 2 to 5 sites per batch. The new tendering arrangement facilitates the new entrants in acquiring a critical mass of PFS to achieve economy of scale for an effective competition in the auto-fuel retail market. |

Since the introduction of the new tendering arrangements in June 2003, two new operators have obtained 35 out of the 61 PFS sites put up for tender and successfully entered the market. The share of the three biggest operators in terms of the number of PFS has dropped from over 93% to about 70%. These figures have demonstrated that the new tendering arrangements have effectively enhanced the competition in auto-fuel retail market.

To further enhance competition in Hong Kong’s auto-fuel market, the Government has also introduced the following measures –

| (a) | To improve the display of price information at PFSs, for PFS sites being / to be tendered / retendered, the Government will require, through making it a lease condition, that a price information board as approved by the Environment and Ecology Bureau (EEB) indicating the price of petrol, diesel, liquefied petroleum gas and other petroleum products (if applicable) sold in the PFS shall be erected within the PFS; and |

| (b) | To facilitate the private sector to convert privately-held land to PFS use with a view to enhancing competition, the Government will provide one-stop service, which includes coordinating communications between applicants and the relevant government departments; as well as the provision of technical advice by government departments to the applicants during the process of planning permission / amendment of plan application (if applicable) of private land for PFS use and the relevant land procedures. Should you wish to obtain more information about the one-stop service, you may contact EEB at ebenq@eeb.gov.hk |

To improve the transparency of prices of fuel products, we post onto the website, on a weekly basis, the movements in local import prices and retail prices of auto-fuel in comparison with movements in FOB prices of Singapore unleaded petrol and motor vehicle diesel. The objective of publishing the data is to inform public better of the market trend of auto-fuel prices.

In addition, local oil companies generally offer various kinds of discounts and concessions to attract customers at present, the actual price paid by customers is often lower than the retail price. Hence, we have commissioned the Consumer Council to post onto its website the local auto-fuel retail prices and information on various types of discounts and promotional offers provided by oil companies, and to launch the "Oil Price Watch" website and mobile application for consumers’ convenience in comparing prices and discounts offered by respective oil companies so as to make informed choices that suit their needs, thereby enhancing price competition.

Data Chart

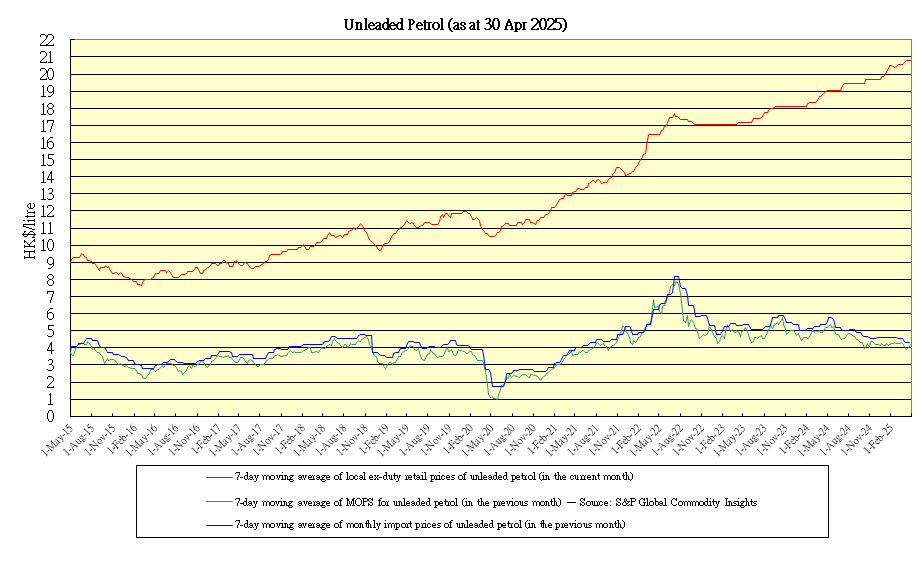

A. UNLEADED PETROL - Price Movements

The chart for unleaded petrol indicates the following:

- 7-day moving average of local ex-duty retail prices for unleaded petrol (Note 1)

- 7-day moving average of the Mean of Platts Singapore for unleaded petrol – Source: S&P Global Commodity Insights, ©2025 by S&P Global Inc. (Note 2)

- 7-day moving average of the monthly average import prices of unleaded petrol (Note 3)

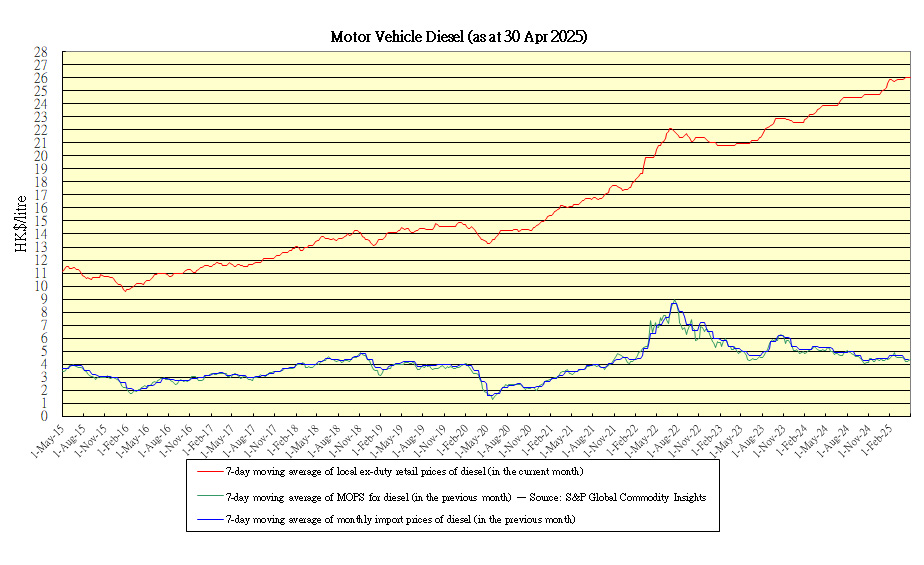

B. MOTOR VEHICLE DIESEL - Price Movements

The chart for motor vehicle diesel indicates the following:

- 7-day moving average of local ex-duty retail prices for Ultra Low Sulphur Diesel (up to 30 November 2007) /Euro V Diesel (from 1 December 2007) (Note 1)

- 7-day moving average of the Mean of Platts Singapore for Ultra Low Sulphur Diesel – Source: S&P Global Commodity Insights, ©2025 by S&P Global Inc. (Note 2)

- 7-day moving average of the monthly average import prices of Ultra Low Sulphur Diesel/Euro V Diesel (Note 3)

Note

1. The local ex-duty retail prices in the charts above are pump prices net of duty but before taking into account any discounts. In fact, oil companies are offering various types of discounts to consumers (including walk-in discounts, credit card discounts or oil company membership card discounts etc.). The relevant information on prices and discounts are available at "Oil Price Watch". Please see the Table for an analysis of walk-in discounts offered by oil companies in the past 5 years.

2. As auto-fuel sold locally are all imported, mainly from refineries in the Asia Pacific Region, the import prices of local auto-fuel are closely correlated with commodity prices in the Asia Pacific fuel market. The Mean of Platts Singapore (MOPS) is the generally accepted benchmark for Asia Pacific FOB fuel prices.

3. Import prices compiled are based on information given in trade declarations which importers are required by the Import and Export (Registration) Regulations to lodge with Customs and Excise Department. Declarations received by the Customs and Excise Department are then forwarded to the Census and Statistics Department for compilation of trade statistics. All declarations, which are processed in compiling trade statistics, are checked against cargo manifests supplied by carriers to ensure that there are no omissions or duplications.

Importers are, by law, allowed 14 days to lodge declarations with the Government. The Census and Statistics Department would verify and process the information and release import price statistics for a given month with a time lag of around four weeks. The respective import price statistics and charts are available at the website of the Legislative Council - Panel on Environmental Affairs.

Import prices statistics of major oil products (Legislative Council)

| Monitoring of the Prices of Domestic Liquefied Petroleum Gas |

In a free market economy, the prices of domestic liquefied petroleum gas (LPG) in Hong Kong are determined by LPG suppliers having regard to commercial practices and their operating costs.

There are five domestic LPG suppliers in Hong Kong, with IP&E GBA Limited (IP&E, ExxonMobil LPG brand licensee), DSG Energy Limited (Shell Gas licensee) and Sinopec (Hong Kong) Gas Company Limited (Sinopec) providing both cylinder and piped domestic LPG while two other suppliers (viz. New Ocean Energy Holdings Limited and Concord Oil Hong Kong Limited) only provide cylinder domestic LPG. The suppliers review their product prices regularly. In this regard, DSG Energy, once every three months (i.e. at end of January, April, July and October), sets the listed prices of domestic piped LPG and wholesale prices of cylinder domestic LPG for the coming three months by forecasting the import prices for the coming three months in the light of the latest international LPG prices, and making positive or negative adjustment for any difference between the actual import prices and the forecast import prices in the last review. In addition, DSG Energy reviews its operating costs once every twelve months according to this mechanism. Meanwhile, IP&E and Sinopec conduct independent regular reviews on the listed prices of domestic piped LPG and wholesale prices of cylinder LPG according to their respective pricing adjustment mechanisms taking into account various factors, including LPG import prices, operating costs, equipment maintenance, market dynamics, etc.

In monitoring the prices of domestic LPG, the Government makes reference to the movements of international LPG prices (Saudi Arabia monthly exporting Contract Price) and local LPG import prices and assess whether the price adjustments are reasonable. The Government understands and is concerned about the impact of domestic LPG prices on the public and therefore encourages the industry to enhance transparency on price setting.

The retail prices of domestic cylinder LPG are set by individual distributors. The Census and Statistics Department has compiled statistics on average retail prices of cylinder domestic LPG in its monthly submission to the Legislative Council – Panel on Environmental Affairs. The relevant information is accessible at the link below:

Average retail prices statistics (Legislative Council)

For the suppliers (Note 1) providing domestic piped LPG, their historical domestic piped LPG price data since 2016 are summarized in the table below:

| Effective date | DSG Energy (Shell prior to 2018) (Note 2) | Sinopec (Note 2) |

|---|---|---|

| $/cu.m. | $/cu.m. | |

| End of Jan 2016 | 30.65 | 30.65 |

| End of Apr 2016 | 31.97 | 31.97 |

| End of Jul 2016 | 30.61 | 30.61 |

| End of Oct 2016 | 33.36 | 33.36 |

| End of Jan 2017 | 34.90 | 34.90 |

| End of Apr 2017 | 33.93 | 33.93 |

| End of Jul 2017 | 32.35 | 32.35 |

| End of Oct 2017 | 37.96 | 37.96 |

| End of Jan 2018 | 36.16 | 36.16 |

| End of Apr 2018 | 34.80 | 34.80 |

| End of Jul 2018 | 37.68 | 37.68 |

| End of Oct 2018 | 39.61 | 39.61 |

| End of Jan 2019 | 33.35 | 33.35 |

| End of Apr 2019 | 37.86 | 37.86 |

| End of Jul 2019 | 34.38 | 34.38 |

| End of Oct 2019 | 36.77 | 36.77 |

| End of Jan 2020 | 38.94 | 38.94 |

| End of Apr 2020 | 34.02 | 34.02 |

| End of Jul 2020 | 36.68 | 36.68 |

| End of Oct 2020 | 39.56 | 39.56 |

| End of Jan 2021 | 41.22 | 41.22 |

| End of Apr 2021 | 40.42 | 40.42 |

| End of Jul 2021 | 43.47 | 43.47 |

| End of Oct 2021 | 48.12 | 48.12 |

| End of Jan 2022 | 44.59 | 44.59 |

| End of Apr 2022 | 49.59 | 49.59 |

| End of Jul 2022 | 45.57 | 45.57 |

| End of Oct 2022 | 42.04 | 42.04 |

| End of Jan 2023 | 44.36 | 44.36 |

| End of Apr 2023 | 45.90 | 45.90 |

| End of Jul 2023 | 41.76 | 41.76 |

| End of Oct 2023 | 45.81 | 45.81 |

| End of Jan 2024 | 46.52 | 46.52 |

| End of Apr 2024 | 48.01 | 48.01 |

| End of Jul 2024 | 46.94 | 46.94 |

| End of Oct 2024 | 47.70 | 47.70 |

| End of Jan 2025 | 48.36 | 48.36 |

| End of Apr 2025 | 47.34 | 47.33 |

| End of Jul 2025 | 48.10 | 48.10 |

| End of Oct 2025 | 46.74 | 46.74 |

| End of Jan 2026 | 47.28 | 47.28 |

Note

1. IP&E explains that it sells piped LPG to the pipeline operators, rather than to the end consumers direct. The actual selling price to the end consumers is in turn determined by the pipeline operators. The piped LPG price is one of the commercial terms with IP&E’s operators, and is therefore confidential and proprietary in nature. IP&E is hence unable to make public the relevant information.

2. Price information is collected from DSG Energy's and Sinopec's websites.

3. The price information of respective LPG suppliers is for reference only and does not represent the actual service charge of individual customer. For the actual service charge of each service area / estate, please contact the respective LPG suppliers / operators directly.

Disclaimer

1. The information on this website including but not limited to that on oil prices ("the Information") provided by the Government of the Hong Kong Special Administrative Region ("the Government") is for general reference only and is not intended to be relied upon. Whilst the government endeavors to ensure the accuracy of the Information, no statement, representation or warranty, express or implied, is given by the Government as to its accuracy, timeliness, completeness or appropriateness for use in any particular circumstances. The Government will not be liable for any error, omission, misstatement or misrepresentation, express or implied, concerning the Information, and will not have or accept any liability, obligation or responsibility whatsoever for any loss, destruction or damage (including without limitation consequential loss, destruction or damage) howsoever arising from or in respect of using, misusing, inability to use, or relying on the Information.

2. The Government does not warrant or represent that this website or any e-mail sent to users is free of computer viruses. The Government will not be liable for any loss, destruction or damage arising out of or in relation to a message sent from users to the Government or vice versa over the internet.

3. The Government shall not be responsible for any loss or damage whatsoever arising out of or in connection with the Information. The Government reserves the right to revise, omit, suspend or edit the Information at any time in its absolute discretion without giving any reason or prior notice to users. Before acting upon the Information, users are responsible for making their own assessment of the Information; advised to verify the Information by making reference, for example, to original publications and; advised to obtain independent advice from relevant professionals.

4. By visiting this website, you agree to accept unconditionally the terms of this Disclaimer, which may be revised and/or amended from time to time by the Government without prior notice to users. Please check this Disclaimer regularly for any revisions and/or amendments which may be made.

Intellectual Property Rights Notice

1. The content available on this website, including but not limited to all text, tables, charts, graphics, drawings, diagrams, photographs and compilation of data or other materials are subject to copyright owned by the Government or other entities. Except as expressly permitted herein or where prior written authorization is obtained from the Environment and Ecology Bureau or other entities, any reproduction, adaptation, distribution, dissemination, making available of such copyright works to the public or use of such copyright works in any form is strictly prohibited.

2. Permission is granted for users to download the Government copyright materials herein to store them in local computers, provided that this is solely for personal or non-commercial use, and provided further that this copyright notice is downloaded at the same time. Users should note that this permission only applies to Government copyright materials.